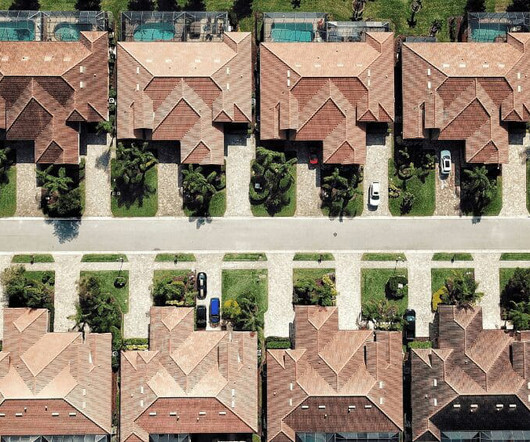

Yes, Cash Buyers Pay Closing Costs, and Sometimes Even the Seller’s Fees

HomeLight

NOVEMBER 9, 2021

Closing costs are assumed to be part of doing business in real estate, but do cash buyers pay closing costs? Yes, you can expect charges for attorney hours, taxes, plus title and recording fees to still apply, though the use of cash can greatly reduce a buyer’s closing costs with the elimination of mortgage fees.

Let's personalize your content