Weaker economy, inflation caused mortgage delinquency uptick in Q4

Housing Wire

FEBRUARY 16, 2023

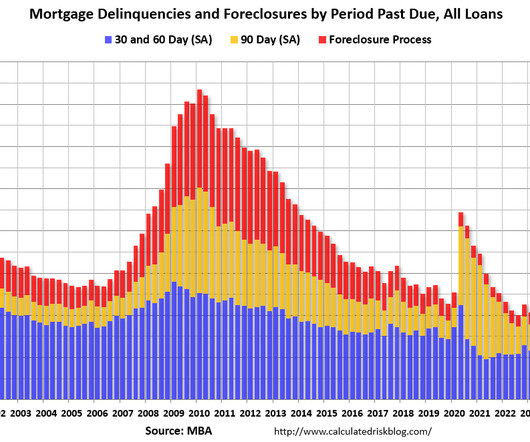

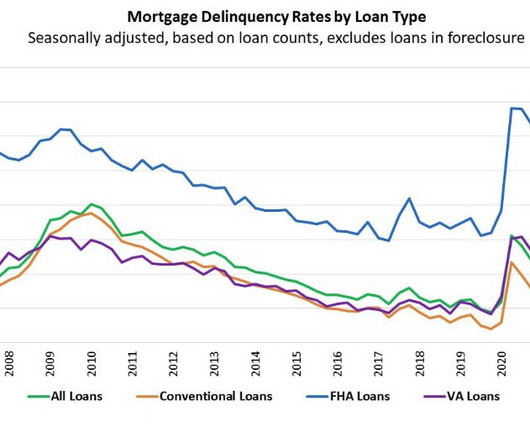

The delinquency rate for mortgage loans on one- to four-unit residential properties rose 51 basis points from the previous quarter to a seasonally adjusted rate of 3.96% of all loans outstanding in the fourth quarter of 2022, according to the Mortgage Bankers Association (MBA).

Let's personalize your content