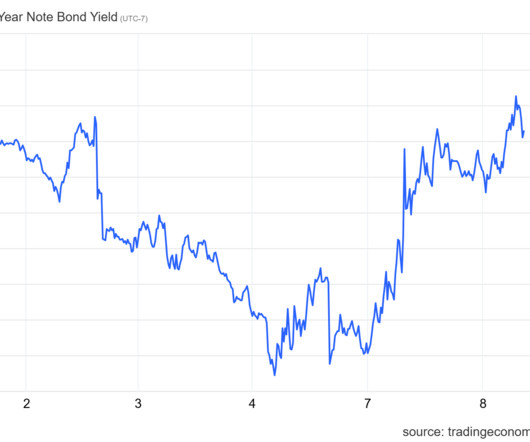

Better mortgage spreads boost housing demand in 2025

Housing Wire

MAY 17, 2025

One of the lesser known storylines in housing economics is that the improvement in mortgage spreads since 2023 has contributed to a noticeable trend in purchase application data for 2025, which is now showing 15 consecutive weeks of positive year-over-year growth. A historical review of these spreads shows that they are currently elevated.

Let's personalize your content