When Can a Buyer Cancel a Home Purchase Agreement?

HomeLight

MARCH 7, 2024

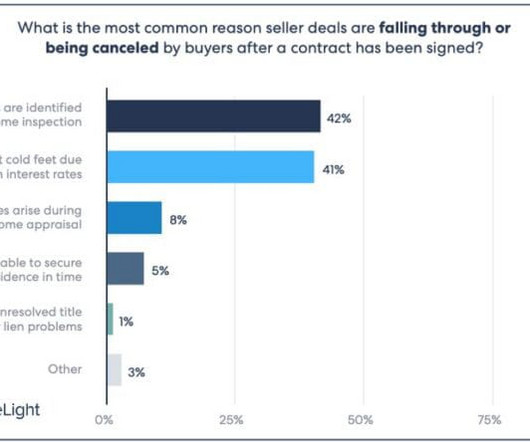

Here’s a quick look at common factors prompting home buyers to back out of a purchase agreement: Financing issues: Buyers struggling to secure a mortgage or facing unfavorable loan terms may opt to cancel the purchase. What is an option period?

Let's personalize your content