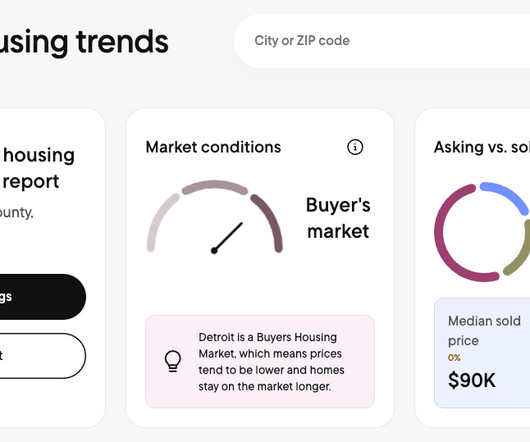

Precision partners: How AI and human expertise are elevating lending excellence

Housing Wire

MAY 1, 2025

Artificial intelligence has moved from a buzzword to boardroom priority in lending. After years of hype and speculation, we’re finally seeing real transformation in how loans are processed, underwritten, and serviced. This focus on precision distinguishes lending from other AI applications.

Let's personalize your content