Massachusetts set to bar home sellers from requiring inspection waivers

Housing Wire

JUNE 16, 2025

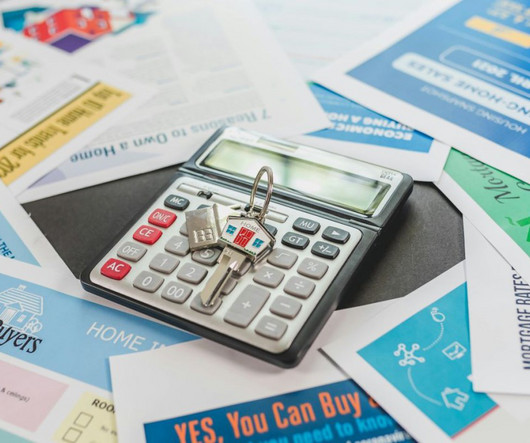

Massachusetts homebuyers will soon be protected from being pressured into waiving home inspections under new regulation. It also prevents sellers from accepting offers if they are informed in advance that the buyer intends to forgo an inspection. A home inspection is an important step in buying a property.

Let's personalize your content