Mortgage delinquencies increase for second straight quarter: MBA

Housing Wire

FEBRUARY 8, 2024

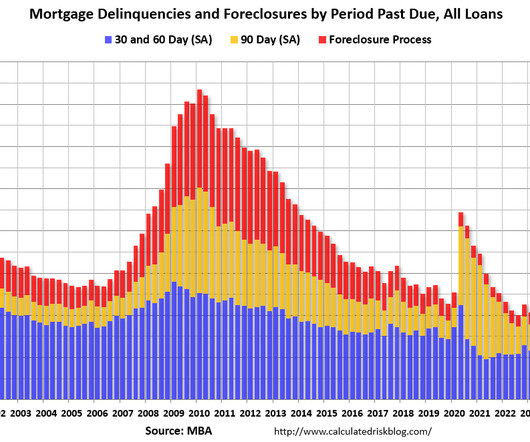

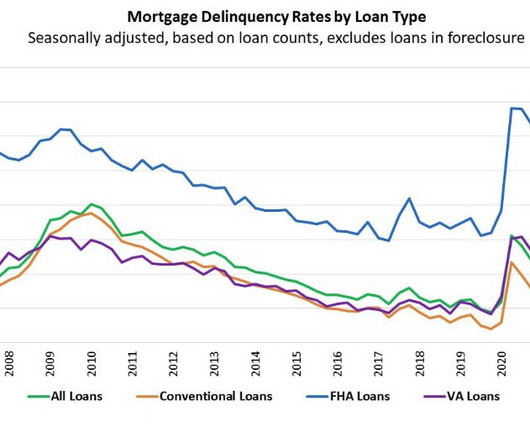

“Mortgage delinquencies increased across all product types for the second consecutive quarter,” Marina Walsh, MBA’s vice president of industry analysis, said in a statement. Department of Veterans Affairs (VA) loans rose to 4.07%, up from 3.76%. And the past-due rate for U.S.

Let's personalize your content