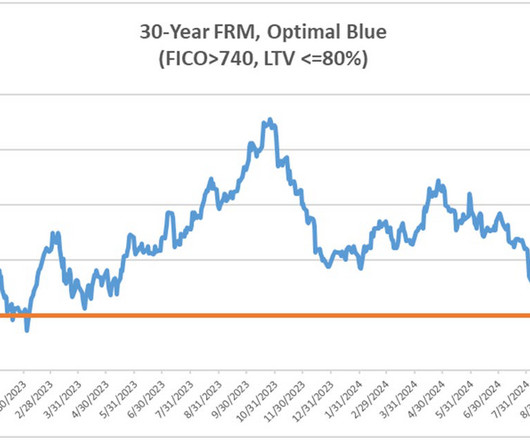

Mortgage rate uptick leaves summer market on standby

Real Estate News

JULY 10, 2025

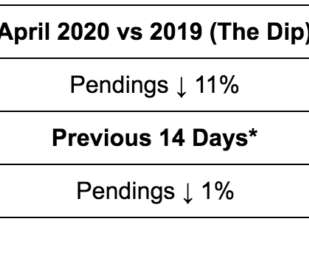

Skip to Content Agents Brokerages MLS/Assn Tech Industry By the Numbers Consumer Adobe Stock By the Numbers Mortgage rate uptick leaves summer market on standby Mortgage applications are up, but a rise in rates combined with job loss concerns and tariff uncertainty could kill the momentum.

Let's personalize your content