When Will the Soaring Mortgage Rates Finally Go Down in 2025?

Marco Santarelli

APRIL 23, 2025

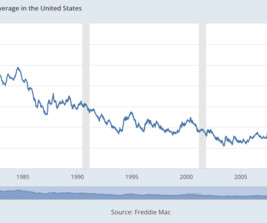

The Fed sets the federal funds rate, which is the rate banks charge each other for overnight lending. While mortgage rates aren't directly tied to the federal funds rate, they tend to follow the same trends. Mortgage rates tend to track the 10-year Treasury yield closely.

Let's personalize your content