Midwest housing markets good for first-time homebuyers: Zillow

Housing Wire

APRIL 5, 2024

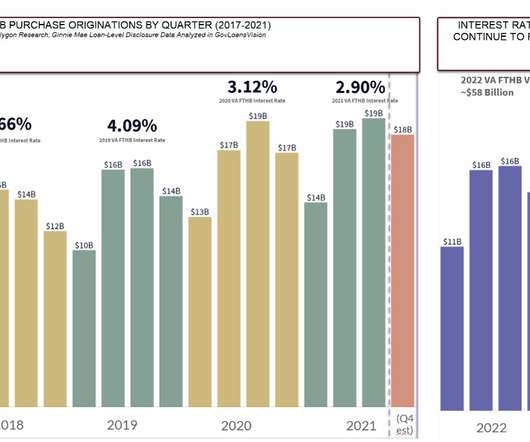

The number of first-time homebuyers made up 32% of all buyers in 2023, according to a report released by the National Association of Realtors. Millennials comprised 75% of this demographic, with older millennials and Generation X (ages 44 to 58) accounting for 44% and 24% of first-time buyers.

Let's personalize your content