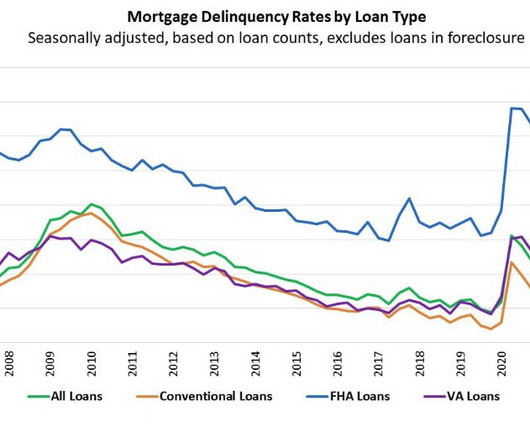

Weaker economy, inflation caused mortgage delinquency uptick in Q4

Housing Wire

FEBRUARY 16, 2023

While recent indicators pointed to resilience in the job market, the MBA forecasts slower hiring and rising unemployment, with the interest rates hitting 5.2% Nonfarm payrolls increased by 517,000 jobs in January from December — far higher than the 187,000 market estimate. by the end of 2023. The unemployment rate declined to 3.4%

Let's personalize your content