More homebuyers seek government-backed loans as an affordability lifeline

Housing Wire

FEBRUARY 3, 2025

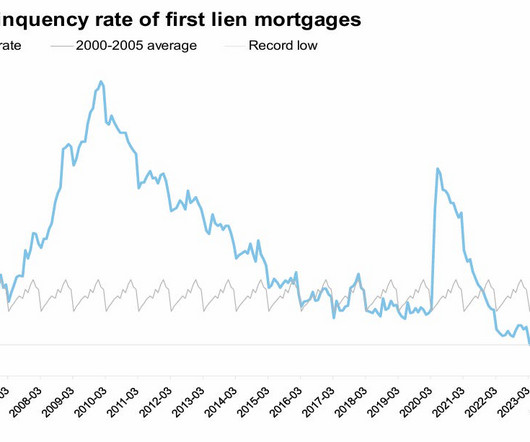

The company’s newest National Housing Market Outlook shows that buyers are gravitating toward government-backed loans in their search for affordability. As a result, more buyers are turning to products like Federal Housing Administration (FHA) loans, which accounted for 24% of primary home purchases in 2024, and U.S.

Let's personalize your content