Transforming the mortgage and real estate process: Insights from Tech100 leaders

Housing Wire

NOVEMBER 26, 2024

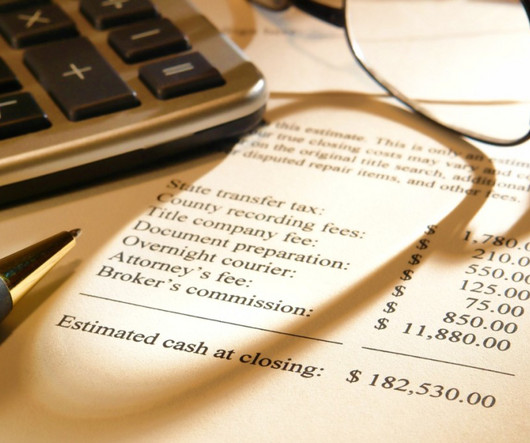

From streamlining title verification to enabling collaborative loan processing and automating key title production tasks, these leaders are helping shape a faster, smarter, and more efficient housing market. We call this process VOT or Verification of Title.

Let's personalize your content