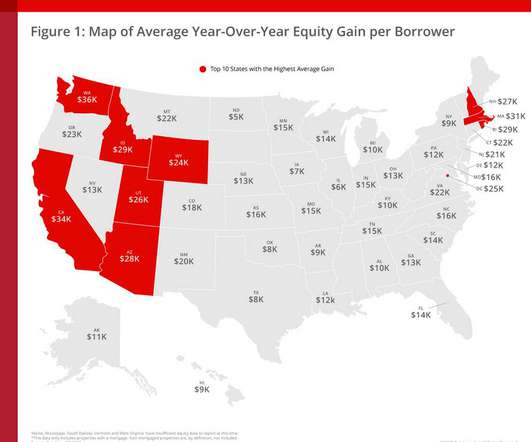

Home equity is the bright gem of the housing market

Housing Wire

MARCH 10, 2023

Stubborn inflation and high interest rates continue to wreak havoc on the mortgage-origination market, but there is one asset class in the housing market that is arguably flourishing in these hard times – home equity. billion in the fourth quarter of 2021,” a recent market assessment by ATTOM shows.

Let's personalize your content