Q3 Update: Delinquencies, Foreclosures and REO

Calculated Risk Real Estate

DECEMBER 8, 2023

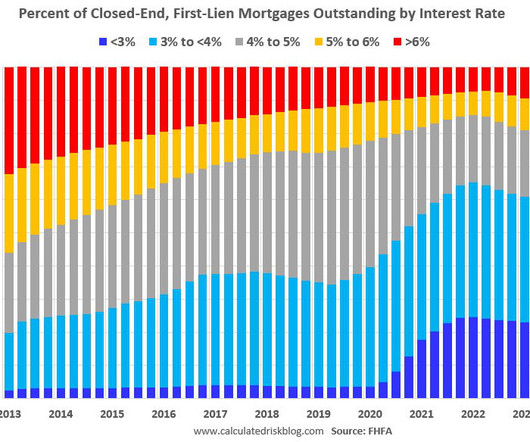

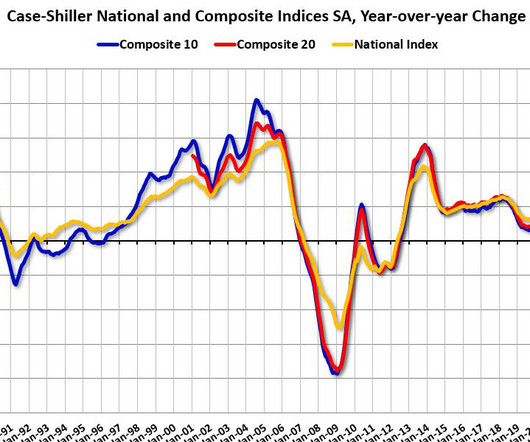

However, I also argued this would NOT lead to a surge in foreclosures and significantly impact house prices (as happened following the housing bubble) since lending has been solid and most homeowners have substantial equity in their homes. of loans are under 3%, 60.3% year over year, representing a collective gain of $1.1

Let's personalize your content