Home prices see highest gain in nearly 15 years

Housing Wire

MARCH 30, 2021

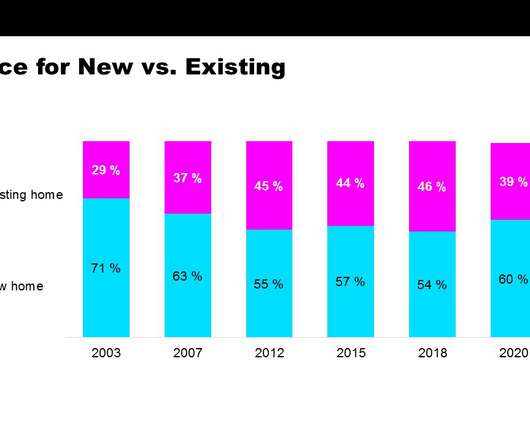

Home prices continued their acceleration in January according to the S&P Corelogic Case-Shiller National Home Price Index, jumping 11.2% year over year, the highest gain in nearly 15 years. The Tuesday report also revealed an 11.1% year-over-year gain in January for the 20-city price index, up from 10.2% the previous month. Overall, prices rose month over month in 19 of the 20 cities tracked, with Cleveland being the only city to see prices drop.

Let's personalize your content