Consumers more confident about making mortgage or rent

Housing Wire

MARCH 22, 2021

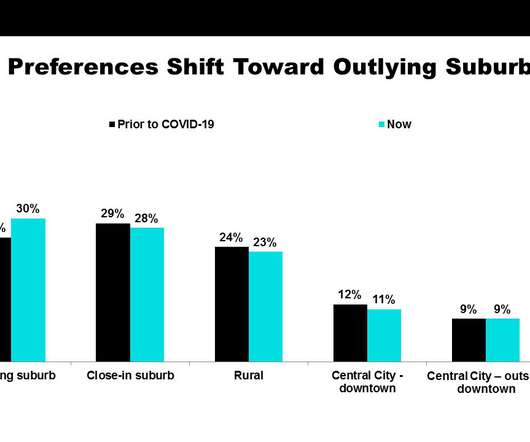

Although many homeowners and renters continue to feel the economic pressure of the pandemic , they’re growing more confident that they can pay their rent or mortgage, according to the latest consumer confidence survey by Freddie Mac. The survey respondents, of which two-thirds are homeowners and one-third are renters, found that more than half of respondents in 2020 expressed concern about making payments, with a high of 71% reported in November.

Let's personalize your content