The Four Most Common Reasons Home Buyers Back Out of Real Estate Transactions

CT Homes

AUGUST 31, 2020

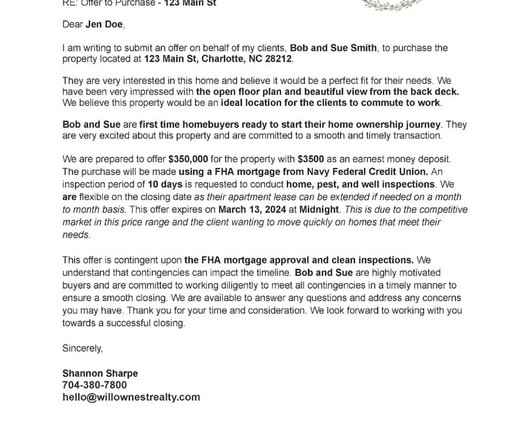

Financing Issues. There is a huge difference between a pre-qualification and a pre-approval. Most lenders or mortgage companies will issue a pre-qualification letter after reviewing the credit report and taking verbal information on income, assets and employment. There is also the issue of the appraisal.

Let's personalize your content