Stop Making These Real Estate Videos (And What to Do Instead)

BAM Media

FEBRUARY 21, 2025

or The Difference Between Pre-Approval and Pre-Qualification. Very rarely do people log on thinking, I really hope I learn something about earnest money deposits today! Im talking about those generic educational videosthings like 5 Tips for First-Time Homebuyers, What Is a Balloon Mortgage? Tell a story.

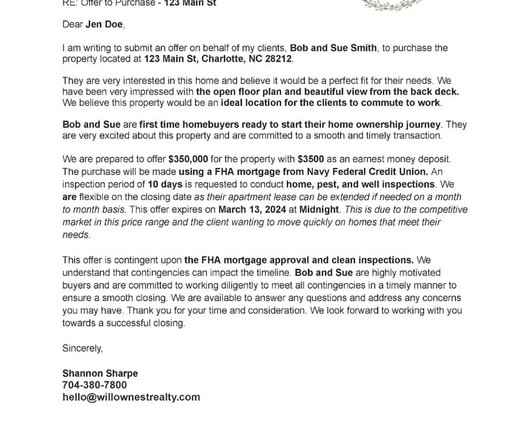

Let's personalize your content