Homebuyers are taking more risks in an obstacle-filled market

Housing Wire

MARCH 21, 2025

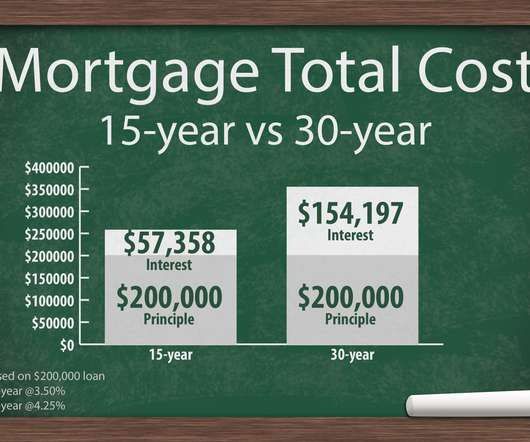

Findings include 71% of loan officers reporting an increase in buyers who are willing to purchase fixer-uppers, explore unconventional financing or accept high mortgage rates despite long-term financial concerns. Many first-time homebuyers are stretching their finances to the limit. Dont obsess with finding the perfect first home.

Let's personalize your content