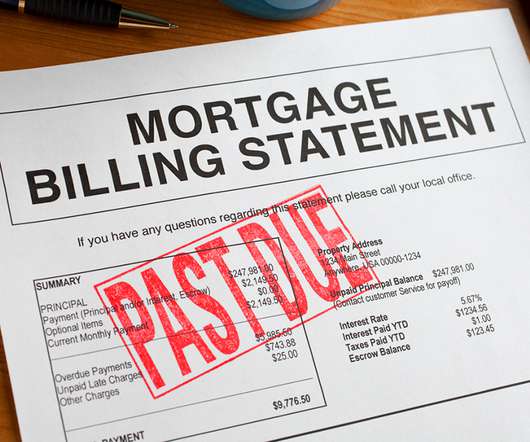

Loan Factory sued by originators for alleged use of unauthorized information

Housing Wire

MARCH 1, 2024

California-based mortgage brokerage Loan Factory was sued by a class of loan originators, who allege that the company used their personal and professional information, without their authorization, on its website in an attempt to drive business. He declined to comment further.

Let's personalize your content