ICE: First-time homebuyers account for record share of agency lending in Q1 2025

Housing Wire

MAY 5, 2025

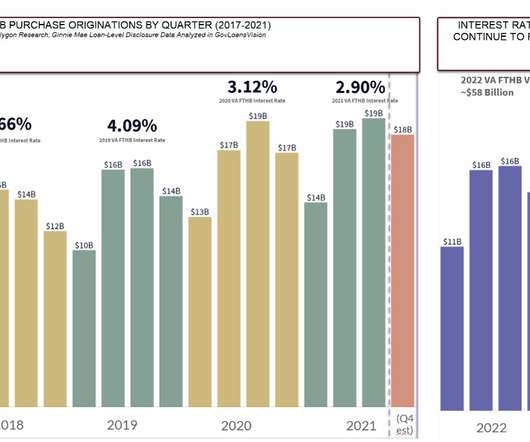

Intercontinental Exchange ‘s May 2025 Mortgage Monitor Report, released Monday, found that first-time homebuyers accounted for a record share of agency purchase lending (58%) in the first quarter 2025. They accounted for a record 82% of agency lending in 2023, more than 75% in 2024 and nearly three-quarters in Q1 2025.

Let's personalize your content