Mortgage apps decline 1.2% despite drop in rates

Housing Wire

MAY 25, 2022

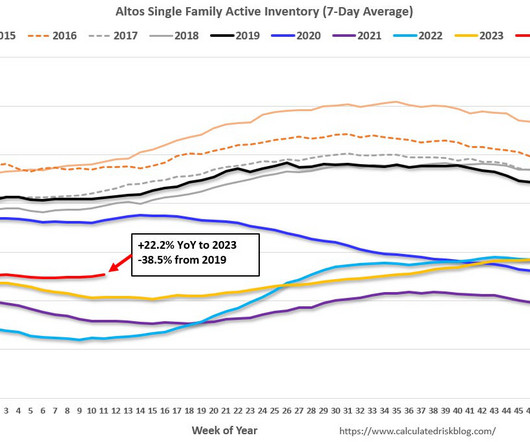

from a week earlier, “close to lows last seen in the spring of 2020 when a significant portion of activity was put on hold due to the onset of the pandemic,” said Kan. Currently, higher rates, low inventory, and high prices are keeping prospective buyers out of the market.”. The post Mortgage apps decline 1.2% from 10.5%

Let's personalize your content