Housing industry pleads with Biden administration to narrow the mortgage spread

Housing Wire

OCTOBER 12, 2023

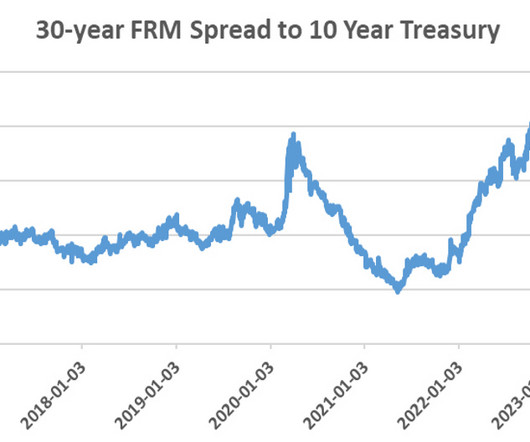

To that end, the CHLA, NAR and ICBA urged that the Federal Reserve shift its policy to maintain its stock of mortgage-backed securities (MBS) and suspend runoff until liquidity and the spread between the 30-year fixed rate mortgages and 10-year Treasury stabilizes.

Let's personalize your content