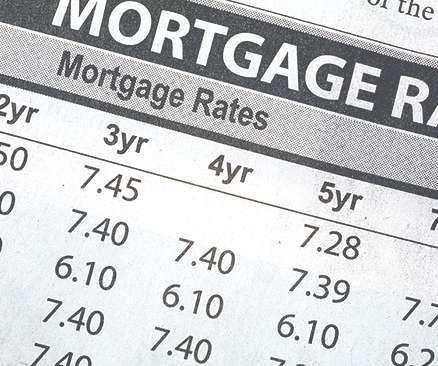

Mortgage Pre-Qualification vs. Pre-Approval: What’s the Difference?

HomeLight

JUNE 19, 2023

Like pre-qualification or pre-approval. Let’s lay it all out: How pre-qualifications and pre-approvals are similar Pre-qualifications and pre-approvals have a few things in common. Learn More What’s a pre-qualification? But what exactly are they?

Let's personalize your content