11 mortgage lead generation ideas to build your client base

Housing Wire

JULY 11, 2025

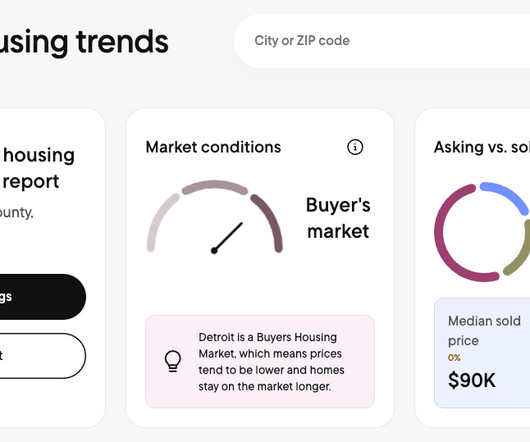

From there, they complete qualification forms and are given loan options and lenders, like you, who can help them. Lead generation for mortgage brokers and officers is all about consistently filling your pipeline with individuals who are interested in buying a home now or in the future. Check out LendingTree. Visit LendingTree 3.

Let's personalize your content