Can You Submit Multiple Offers On Homes At Once – A Legal And Ethical Analysis

Rochester Real Estate

NOVEMBER 5, 2015

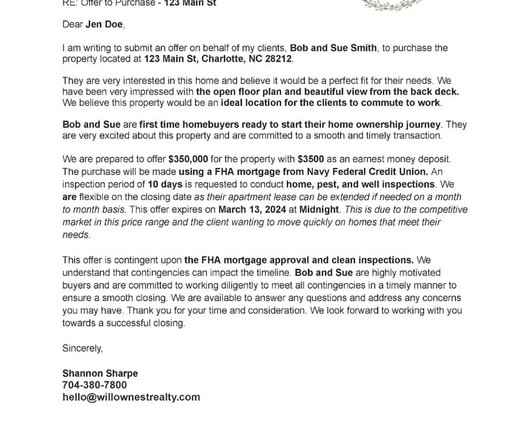

Factors such as earnest money deposits, loan approvals, and real estate agent involvement should be considered. Making multiple offers means putting forth earnest deposits for each property, which can be a considerable financial commitment. What are Simultaneous Offers? Another drawback is the financial aspect.

Let's personalize your content