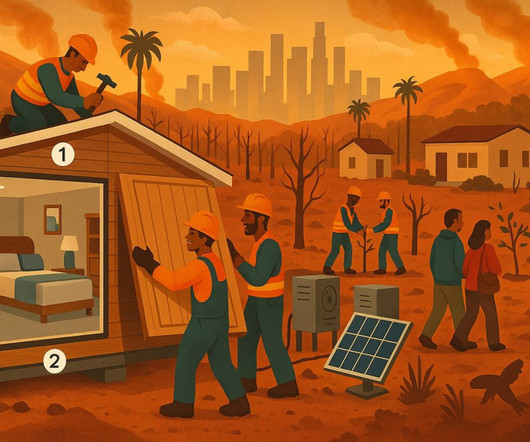

Future-proofing real estate: Why developers are turning to modular for sustainability and resilience

Housing Wire

JANUARY 3, 2025

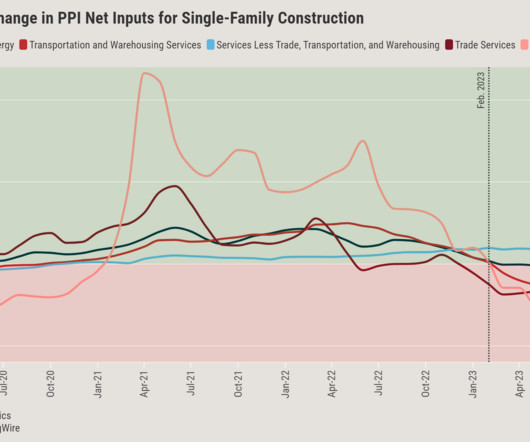

These green building benefits associated with modular construction do not come with the dreaded green cost premium even though recent research shows that developers are willing to pay an average 10% more on construction costs if it allows their business to shift towards a more circular and sustainable business model.

Let's personalize your content