The mortgage rate pendulum swings yet again

Housing Wire

APRIL 17, 2024

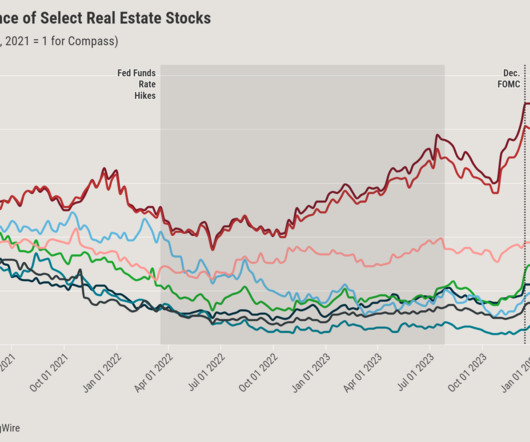

Cuts to the Federal funds rate (and subsequently to mortgage rates) are imminent, traders enthused after December’s meeting of the Federal Open Market Committee in which committee members predicted three rate cuts in 2024. Some experts forecasted as many as six rate cuts in the year based on this news.

Let's personalize your content