Will the 2025 housing market crash like 2008?

Housing Wire

JUNE 9, 2025

housing market is flashing warning signs reminiscent of 2008: rising household debt burdens, persistent inflation and home prices that are outpacing incomes. Debt-to-income ratios (DTIs) are a primary concern. Consumer debt stress is fueling additional risks in the 2025 housing market. The 2025 U.S.

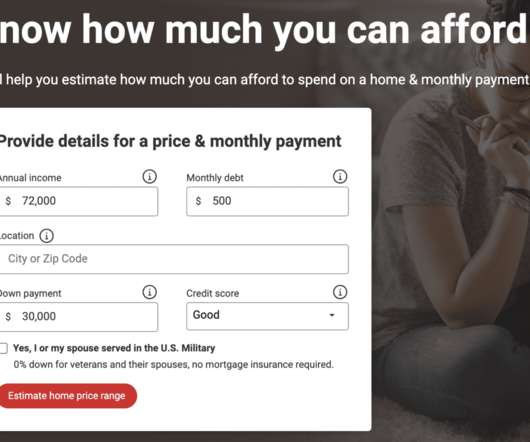

Let's personalize your content