The Red-Hot Housing Market

Housing Wire

DECEMBER 23, 2022

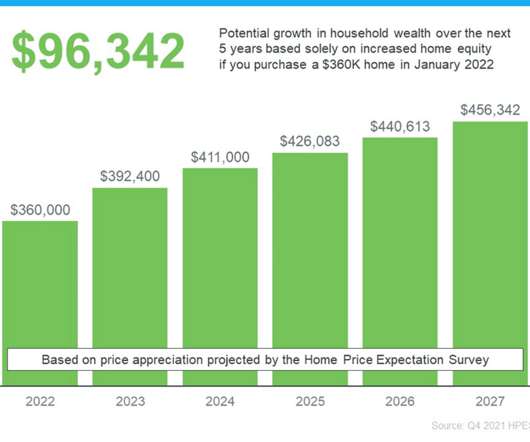

This article is part of our 2022-23 Housing Market Forecast series. The red-hot housing market of the past 2 ½ years was characterized by sub-three percent mortgage rates, fast-paced bidding wars and record-low inventory. The run-up in home prices was driven by rock-bottom mortgage rates and pandemic-fueled demand.

Let's personalize your content