Housing inventory fell last week, but it won’t derail the spring bump

Housing Wire

APRIL 6, 2024

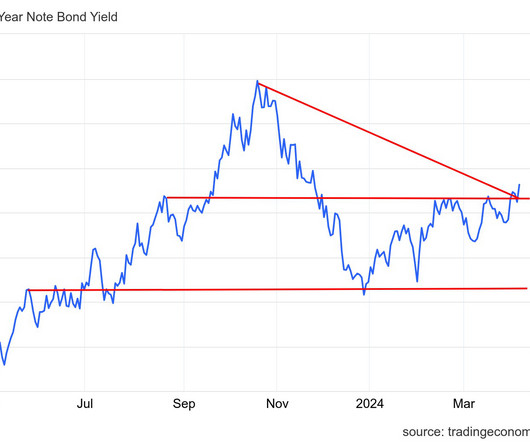

But, despite the weekly moves, the one bright spot for housing is that housing inventory is growing on a year-over-year basis. Also, spreads between the 10-year yield and the 30-year mortgage got better last week, which is a big plus for the future if this trend continues. housing market, and we should ignore the decline last week.

Let's personalize your content