Housing inventory fell last week, but it won’t derail the spring bump

Housing Wire

APRIL 6, 2024

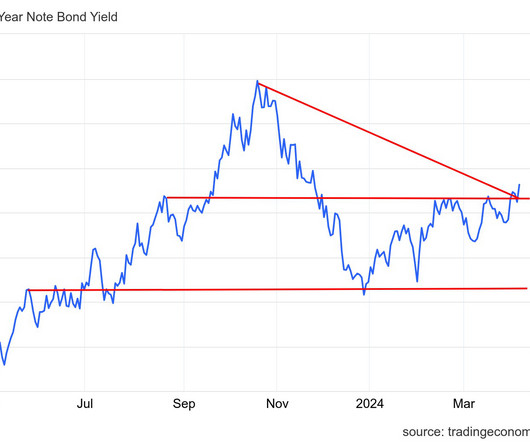

Although I expect some of the weekly data to rebound next week as a result, growth in active and new listings is still trending slower than I thought would happen in 2024. Also, spreads between the 10-year yield and the 30-year mortgage got better last week, which is a big plus for the future if this trend continues.

Let's personalize your content