Mortgage rates are projected to decline, but will that entice buyers?

Housing Wire

FEBRUARY 1, 2023

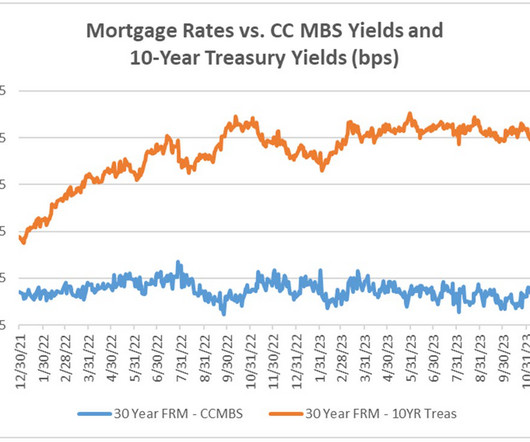

While mortgage rates have been trending lower, rates are still higher than 12 months ago, but some experts anticipate that the downward pressure on rates will provide opportunities for buyers. The 30-year fixed rate was at 6.16% on Tuesday, a decline from 6.5% The 30-year fixed rate was at 6.16% on Tuesday, a decline from 6.5%

Let's personalize your content