Lower mortgage rates are spurring housing demand

Housing Wire

APRIL 5, 2025

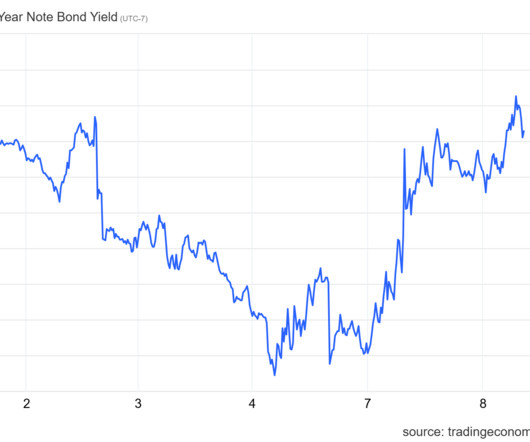

Mortgage rates recently hit a year-to-date low, coinciding with ongoing market disruptions from tariffs. The more encouraging story, however, is that the spring season is shaping up positively for the housing market. Notably, purchase applications show growth both year-to-date and year-over-year. Additionally, our weekly pending contract data and new listings are trending positively compared to last year.

Let's personalize your content