23 Common First-Time Homebuyer Questions: Your Questions Answered

Redfin

JULY 30, 2025

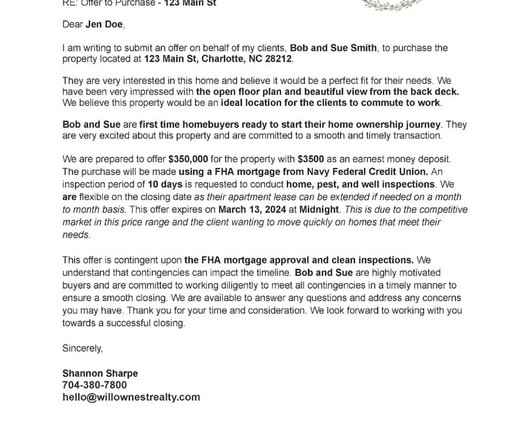

It covers a variety of fees like lender and title fees, property taxes, home inspection, and homeowners insurance, to name a few. Should I get pre-qualified or pre-approved for a mortgage? If you’re considering buying a home, you’ve likely heard of getting pre-qualified or pre-approved.

Let's personalize your content