Home Renovation Loan Options for 2025

The Mortgage Report

AUGUST 1, 2025

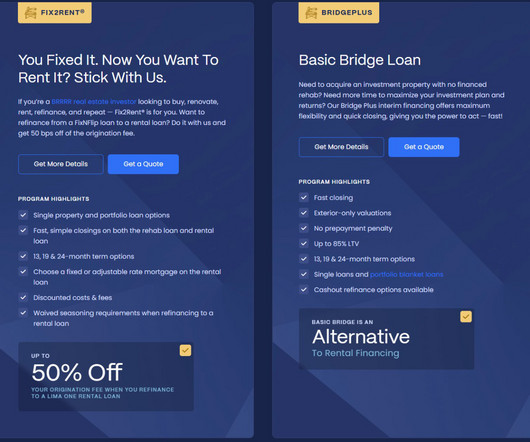

Getting Pre-Approved Down Payment Assistance Buying With Low Credit Buying With Low Income Buying With A Disability Who Has The Best Mortgage Rates? Loan options include FHA 203(k), HomeStyle, VA, and USDA, depending on your qualifications. You can borrow based on the home’s expected value after renovations.

Let's personalize your content