Mortgage Rates Continue to Drop: 30-Year Fixed-Rate Dips to 6.76%

Marco Santarelli

MAY 3, 2025

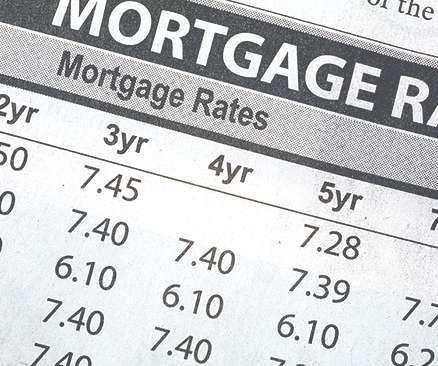

Are you thinking about buying a home, or perhaps refinancing your current mortgage? The news you've been waiting for is here: mortgage rates are continuing their downward trend. As of May 1, 2025, the 30-year fixed-rate mortgage has dipped to 6.76% , a welcome change compared to the earlier part of the year. mortgage rates.

Let's personalize your content