Dream of homeownership feels unattainable to many Americans: Redfin

Housing Wire

APRIL 12, 2024

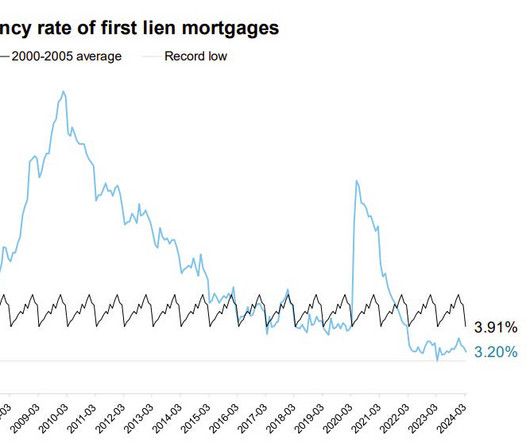

renters don’t believe in their ability to ever own a home, up from roughly 27% less than a year ago. Among other reasons preventing renters from becoming homeowners, respondents listed the difficulty of saving for a down payment (35%), the challenges of affording mortgage payments (33%) and high mortgage rates (32%).

Let's personalize your content