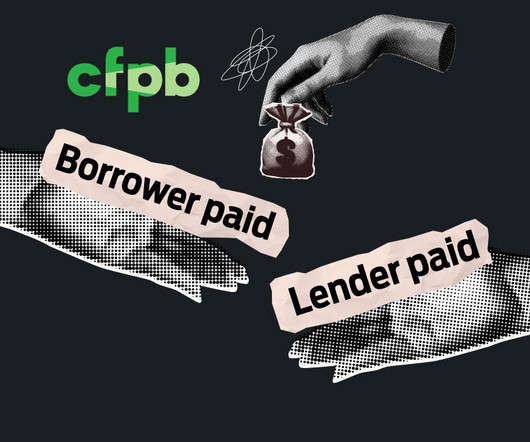

FinLocker says it will cover 100% of mortgage verification costs

Housing Wire

MARCH 27, 2025

“After 28 years in mortgage technology, I’ve been committed to one goal: helping more Americans achieve homeownership,” FinLocker CEO Henry Cason said in a statement. FinLocker also explained that it aims to offer a “competitive edge in a challenging market with a tangible cost” for loan officers.

Let's personalize your content