Mortgage demand slumps over the holidays

Housing Wire

JANUARY 3, 2024

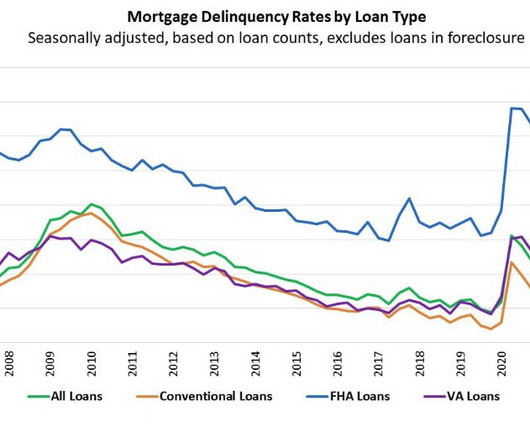

“The housing market has been hampered by a limited supply of homes for sale, but the recent strength in new residential construction will continue to help ease inventory shortages in the months to come,” Kan added. The share of Federal Housing Administration (FHA) loan activity decreased to 14.5% from 15% the week prior.

Let's personalize your content