The mortgage market just had its strongest week in months

Housing Wire

DECEMBER 6, 2023

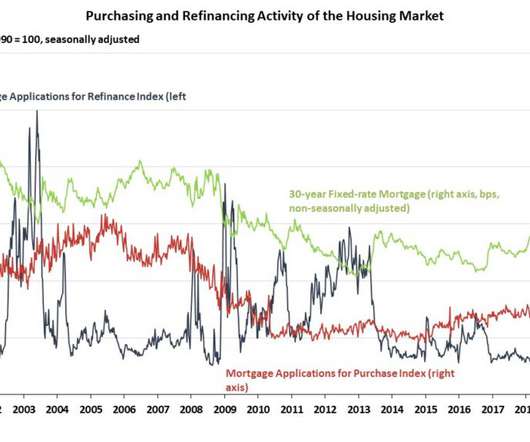

Total home loan applications increased 2.8% 1 compared to the previous week , according to data from the Mortgage Bankers Association (MBA). The 30-year fixed-rate mortgage averaged 7.17% last week. The adjustable-rate mortgage (ARM) share of activity decreased to 7.4% for the week ending Dec.

Let's personalize your content