Portrait of a pre-foreclosure peacemaker

Housing Wire

OCTOBER 24, 2024

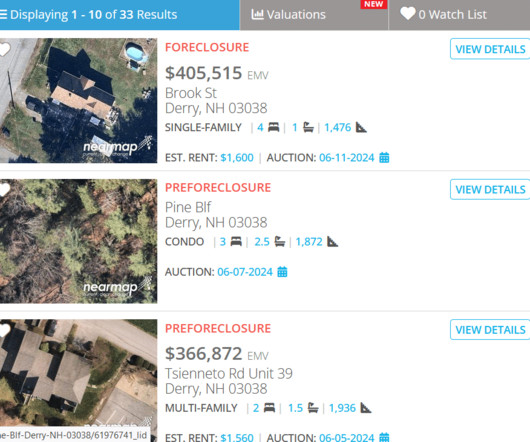

But only about 17,000 delinquent loans completed the foreclosure process in the second quarter of 2024, almost one-third of the nearly 45,000 that completed the foreclosure process in Q1 2020. Often, the best available option for staying in the home is through a loan modification or some other type of repayment plan with the bank.

Let's personalize your content