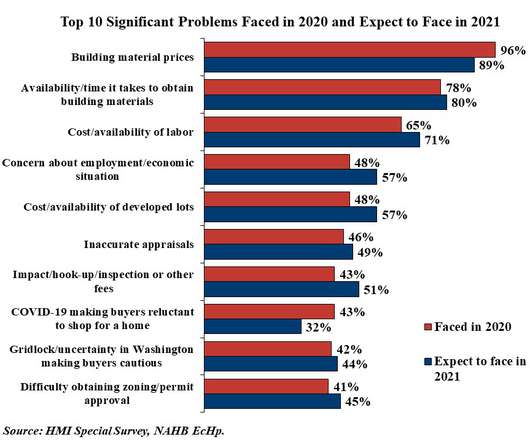

How homebuilders are competing in this crazy market

Housing Wire

FEBRUARY 24, 2021

New home sales in 2021 picked up right where they left off in 2020, near their highest levels in more than a decade thanks to low inventory. The state of the market means increased competition among homebuilders, who are grappling with how to keep prices affordable as their own costs rise. Sales of new single-family houses in January were at a seasonally adjusted annual rate of 923,000 — 4.3% above December’s rate, and a whopping 19.3% higher than original estimates by the U.S.

Let's personalize your content