What is Due Diligence in Real Estate?

Redfin

JUNE 23, 2025

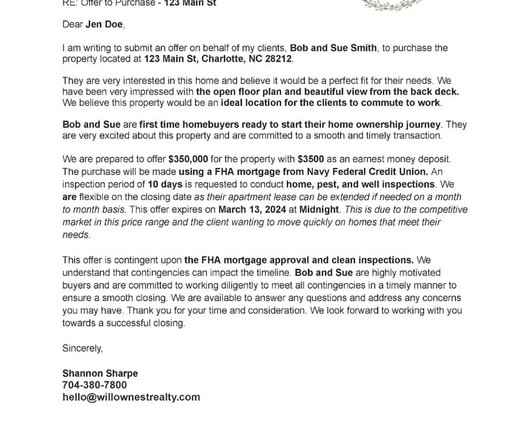

In some states, buyers may also pay due diligence money—a non-refundable fee paid directly to the seller in exchange for this inspection window. While not required everywhere, it’s an important part of the process in certain markets and is separate from the earnest money deposit. How the Process Works 3.

Let's personalize your content