When Can a Buyer Cancel a Home Purchase Agreement?

HomeLight

MARCH 7, 2024

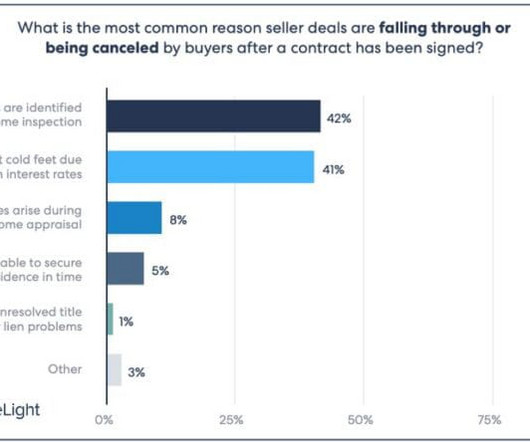

Sale price and terms: The agreed-upon price for the property and the terms of the payment, including the earnest money deposit amount and financing details. Unresolved title issues: Encumbrances or disputes related to the property’s title can complicate the sale, prompting buyers to cancel the agreement.

Let's personalize your content