Making Sense of Mortgage Calculators

Realty Biz

MAY 2, 2023

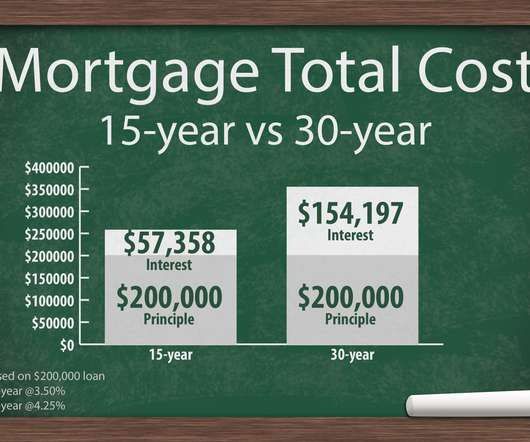

Before venturing into home buying, the first step is determining how much your mortgage loan will cost in the long run and your ability to afford it. Besides the cost and affordability, you may want to compare lenders to ensure you get the best deal before settling for one, and this is where a mortgage calculator comes in.

Let's personalize your content