Is Multifamily Considered Commercial or Residential?

AAOA

JUNE 12, 2025

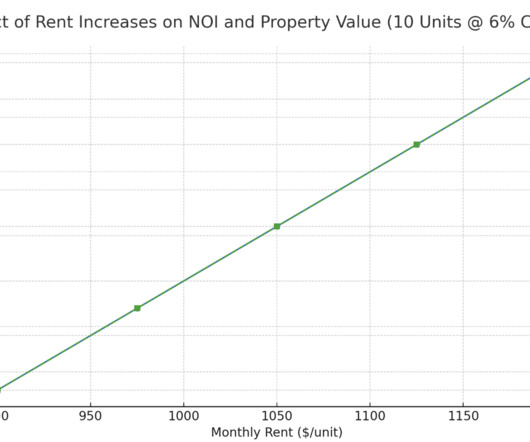

Why This Classification Matters to You as an Investor The second a property crosses the 5-unit threshold, it no longer plays by residential rules. Everything from financing to valuation to property management is handled differently. Lenders evaluate the property’s performance, not your W-2 income.

Let's personalize your content