Republic First Bank closes, sells to Fulton Bank

Housing Wire

APRIL 29, 2024

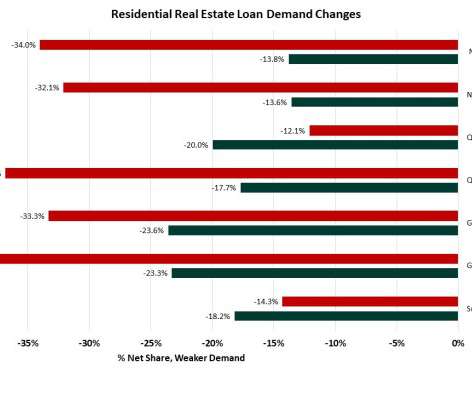

Pennsylvania-based Fulton Bank, National Association of Lancaster, has agreed to assume most of the deposits and assets of Republic First Bank , which state regulators seized on Friday to “protect depositors.” billion in loans. billion in 2023, with most of it being conventional (74%) and purchase (65%) loans.

Let's personalize your content