Will the 2025 housing market crash like 2008?

Housing Wire

JUNE 9, 2025

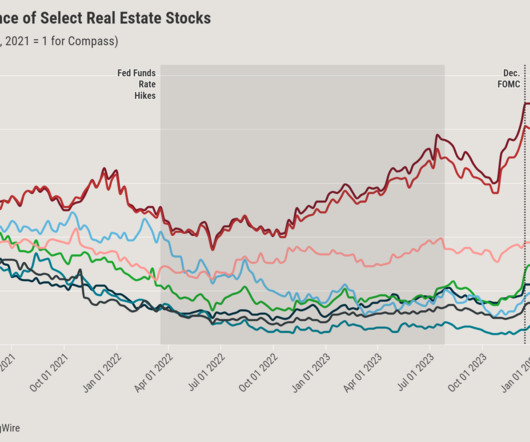

According to the Federal Reserve Bank of New York, credit card delinquency (60+ days past due) reached 3.5% Fixed-rate mortgages comprising 92% of loans in 2024 shield borrowers from the payment shocks of 2008’s adjustable-rate loans 2. Mortgage Servicing Alliance Group, 2025 2. in 2024 – up from 2.8%

Let's personalize your content